Lagging infrastructure

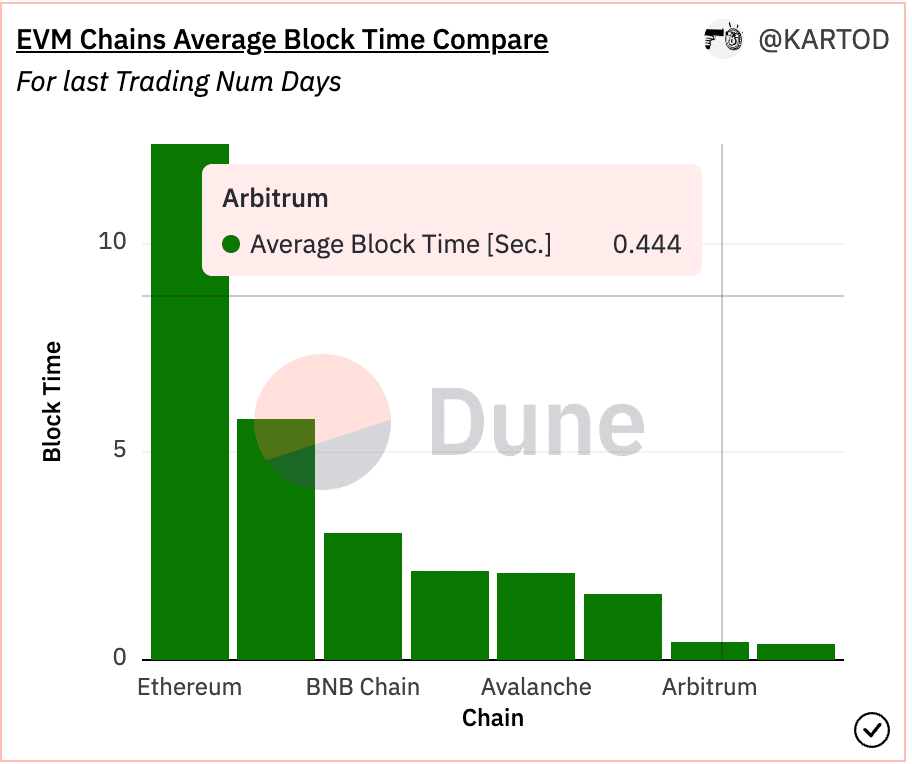

Currently available DeFi derivative exchanges are extremely slow and don't scale too well.

Trading Infrastructure Latency Comparison Table

| Trading latency | |

|---|---|

| Uniswap on ETH | >12s |

| Uniswap on Arbitrum | ~400ms |

| GMX on Arbitrum | ~400ms |

| Solana DeXs | 400-600ms |

| Deribit | ~1-5ms |

| Syndr | 1-30ms |

Scalability

The current market leader dYdX processes orders at a speed of 1000 orders placed/sec with 10-30 trades settled/sec in their current version.

New derivative exchanges on Solana rely on the chain's infrastructure to boost the platform's scalability. Solana derivative exchanges can leverage its 60k+ TPS with ~ 400-600 ms latency/block times but have frequent network halts due to validators going out of sync. Furthermore, it can be hours before the network gets in sync again & restarts. This can be a death blow for a derivatives exchange. Also, sometimes Solana network experiences degraded performance. Transactions may fail to send or confirm. However, with their recent updates with fee markets and recent developments, they can recover from it soon as they are still in nascent stages but complete reliance of derivatives exchange on the chain can be disastrous as we outlined above.

Onchain Risk Engines are fragile & hard to build!

Building completely on-chain risk engines, accurate and robust enough to survive the wild movements within the cryptocurrency markets, is extremely hard. Considering the fact that builders have to implement these risk engines using immutable smart contracts, with no scope for iteration further demonstrates the challenge of the task. Upgradable contracts and tunable risk management factors can help but come with their own issues. Upgradable contracts have limited scope and can be quite high-risk to maintain and upgrade. Tunable risk factors can be helpful but can only account for so many things in advance. Pool-based trading models, such as those seen at Uniswap, GMX, Lyra, etc. try to build alternative mechanisms to compensate for the fact that the underlying decentralized blockchains are slower than the centralized infrastructure used by the CME/NASDAQ/NYSE with their highly efficient low-latency FPGA pipelines. Uniswap v3 effectively acts like an orderbook in a sense and GMX relies on its GLP market makers always out-trading its users.

Onchain Risk for non-linear derivatives == No Go!

The main difference between a spot exchange and a derivatives exchange is its ability to conduct mark-to-market computation of all positions of all traders in the exchange. Pricing non-linear derivative products like Options, Power perpetuals, etc., present an even bigger problem for on-chain risk engines. This can be evidenced by the fact that so far, no DeFi protocol has been able to implement a sufficient robust on-chain pricing engine for Options. Another factor to consider is that normal users can find complicated models hard to understand and, thereby, hard to trust and/or use. The complexity of the product is unwittingly tied to its adoption curve, where simpler models are usually adopted by the general audience faster, especially where there exists a lack of precedence/battle testing.